Entertainment

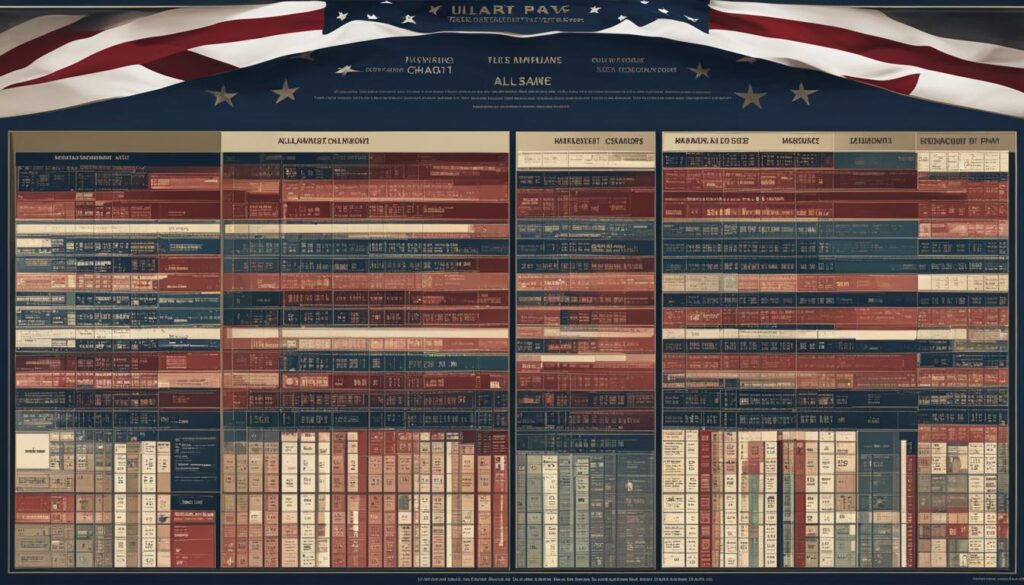

2024 Military Pay Chart – Understand Your Salary

The 2024 military pay chart provides valuable information on the salaries for active duty members of the Navy, Marine Corps, Army, Air Force, Coast Guard, and Space Force. It is essential for service members to understand the military pay scale and compensation rates to effectively manage their finances and plan for the future.

Key Takeaways:

The 2024 military pay chart shows the salaries for active duty members of various branches of the military.

The pay chart reflects a 5.2% increase in military pay compared to the previous year.

Basic pay varies based on rank and years of service.

Officers receive higher pay compared to enlisted service members.

Staying informed about military pay changes is crucial for understanding your salary and benefits accurately.

How Does Military Pay Change?

Military pay automatically increases at the start of each calendar year, in January. The pay increase is typically based on the Employment Cost Index (ECI), which tracks private-sector wages and salaries. For 2024, there will be a 5.2% pay raise, calculated from the ECI. This increase affects all service members and is reflected in the first pay period of the year. However, it’s important to note that the president or Congress may supersede this automatic amount.

Understanding how military pay changes is essential for service members to effectively manage their finances and plan for the future. The annual pay increase ensures that military personnel are adequately compensated for their service and helps maintain competitiveness with the civilian job market. The 5.2% raise for 2024 reflects the continued commitment to supporting the men and women serving in the military.

It’s crucial to stay informed about any changes or updates regarding military pay to ensure accurate financial planning and budgeting.

To illustrate the impact of the pay increase, the table below showcases the monthly basic pay for enlisted service members, taking into account different ranks and years of service:

Paygrade

Years of Service

Monthly Basic Pay

E-1

0

$2,017.20

E-6

Over 10 years

$4,387.80

Note: The above table showcases a small sample of enlisted pay grades. The actual pay structure consists of multiple ranks and years of service, which you can find detailed information on in the official military pay charts and resources.

As demonstrated by the table, military pay varies based on factors such as rank and years of service. The pay increase not only benefits newer service members but also ensures a fair compensation progression for those who have dedicated their career to the military.

Service members should regularly review their military leave and earning statement (LES) to gain a comprehensive understanding of their pay, allowances, deductions, and entitlements. Payroll or finance offices are available to assist with any questions or discrepancies that may arise.

Stay Informed and Prepared

Considering the dynamic nature of military pay, it’s crucial to stay informed and prepared for any changes that may occur during your military career. Regularly accessing reliable sources and staying up-to-date with the latest information will enable you to make well-informed financial decisions.

Next, we’ll explore the various factors that can influence military pay, including paygrade, years of service, and additional allowances. Understanding these factors will provide a more comprehensive perspective on the calculation of military compensation.

Factors That Affect Military Pay

Several factors play a significant role in determining military pay. These include paygrade or rank and the number of years of service. Let’s take a closer look at how these factors impact the monthly basic pay for military personnel.

Paygrade/Rank

The military paygrade or rank directly influences a service member’s compensation. Higher-ranking officers generally receive higher pay compared to enlisted service members. The military pay scale provides clear guidelines on the basic pay rates for each paygrade or rank. For example, an officer starting at paygrade O-1 will receive a different basic pay rate than an officer at paygrade O-5. The table below illustrates the basic pay range for enlisted service members:

Pay Grade

Years of Service

Monthly Basic Pay

E-1

No experience

$2,017.20

E-6

Over a decade

$4,387.80

Years of Service

The number of years served in the military is another crucial factor that influences pay. As service members accumulate more years of service, they become eligible for pay increases. For example, an enlisted person with a paygrade of E-1 will experience a gradual increase in basic pay as they progress to higher paygrades over the course of their military career. Here’s an example showing the impact of years of service on pay for enlisted service members:

Pay Grade

Years of Service

Monthly Basic Pay

E-1

No experience

$2,017.20

E-6

Over a decade

$4,387.80

As shown in the table above, a more senior enlisted person with a paygrade of E-6 and over a decade of service will earn a higher monthly basic pay compared to an enlisted service member with a paygrade of E-1 and no experience.

These factors, paygrade/rank, and years of service, are considered when determining the monthly basic pay for military personnel. Understanding how these factors interplay helps service members gauge their career progression and potential earning potential.

Understanding Military Leave and Earning Statement (LES)

The Leave and Earning Statement (LES) is a vital document for service members, providing comprehensive information about their military paycheck and various financial details. It offers a detailed breakdown of entitlements, deductions, allotments, leave balance, and tax withholding. Reviewing your LES every pay period is crucial to ensure accuracy and identify any discrepancies.

The LES includes essential information such as:

Pay period coverage

A summary of entitlements

Deductions and allotments

Leave balance

Federal tax information

To access your LES, you can log in to the Defense Finance and Accounting Service (DFAS) myPay website. It provides an easy-to-understand interface where you can view, download, and print your LES at any time. It is important to keep track of your LES records for future reference and to ensure accurate reporting of your military earnings.

If you have any questions or notice discrepancies concerning your military pay, it is essential to reach out to the appropriate payroll or finance office. They can provide valuable guidance and assistance in resolving any issues and ensuring your military paycheck is correct.

“Your LES is not just a piece of paper; it represents your hard work and dedication to serving in the military. Take the time to understand and review it regularly to stay informed about your earnings and benefits.”

By understanding and regularly reviewing your military Leave and Earning Statement (LES), you can effectively manage your finances and have a clear understanding of your military compensation.

Important Information Provided in the LES

Action Required

Verify Personal Information

Ensure your name, rank, and other personal details are correct.

Check Pay Entitlements

Review the summary of entitlements to ensure accuracy.

Review Deductions

Confirm that deductions are authorized and in line with your expectations.

Monitor Leave Balance

Keep track of your accrued leave and confirm its accuracy.

Understand Allotments

Ensure any allotments are correctly stated and reflect your authorized deductions.

Verify Tax Withholding

Check your federal tax information for accuracy and make adjustments if necessary.

Keeping a close eye on your LES grants you control over your finances and allows you to easily identify any issues related to your military paycheck. By understanding the information provided and promptly addressing any concerns, you can ensure that your military pay accurately reflects your service and entitlements.

Tax-Free Allowances and Special Pay

In addition to basic pay, military compensation extends beyond the monthly salary. Tax-free allowances and special pay form an integral part of a service member’s overall income. These additional forms of compensation contribute significantly to the financial well-being of military personnel.

One notable example of a tax-free allowance is the Basic Allowance for Housing (BAH). The BAH is specifically tailored to assist service members in covering the cost of housing. This allowance is excluded from gross income for tax purposes, providing additional financial relief.

Moreover, various allowances and special pay are available based on duty station, qualifications, or military specialties. These additional monetary benefits provide recognition and compensation for certain service-related circumstances. Whether it’s combat duty, hazardous assignments, or language proficiency, these special pays acknowledge the unique responsibilities and risks associated with specific military roles.

Overview of Tax-Free Allowances and Special Pay:

Allowance/Pay

Description

Basic Allowance for Housing (BAH)

An allowance provided to offset the cost of housing, excluded from taxable income.

Basic Allowance for Subsistence (BAS)

An allowance to compensate for the cost of meals.

Clothing Allowances

Various clothing allowances to cover initial clothing needs, replacement costs, civilian clothing requirements, and special situations.

Aviation Incentive Pays

Additional compensation provided to officers and enlisted personnel performing flight duties.

Hazardous Duty Incentive Pay

Pay for military personnel engaged in hazardous assignments, acknowledging the risks associated with such duties.

These allowances and special pay contribute to a service member’s overall military compensation. The specific amounts and eligibility criteria vary based on individual circumstances, duty assignments, and qualifications. Therefore, it is essential for service members to review and understand the various tax-free allowances and special pay they may be eligible to receive.

Having a comprehensive understanding of these additional forms of compensation enables service members to effectively manage their finances and make the most of their military earnings. It is important to consult official military resources and speak with finance personnel to obtain accurate and up-to-date information regarding tax-free allowances and special pay.

Where to Find Information About Military Pay Changes

To stay informed about military pay changes and other benefits, it is advisable to bookmark the Military Pay section of Military.com. This section provides the latest news and updates on military pay, as well as access to pay charts, pay calculators, and more.

Additionally, updating your Newsletter Subscriptions on Military.com ensures that you receive regular updates on military benefits, including compensation, directly to your inbox. It is essential to stay up-to-date with military pay changes to understand your salary and benefits accurately.

Military.com provides a comprehensive resource for tracking changes in military pay and accessing relevant information. Whether you are an active-duty service member, a veteran, or a military family member, staying informed about military pay changes is crucial for financial planning and understanding your compensation.

“Keeping up with military pay changes is an essential part of managing your finances and ensuring that you receive the correct salary and benefits. By bookmarking the Military Pay section of Military.com and subscribing to their newsletters, you can stay informed about the latest updates and changes.” – Military Finance Expert

With increasingly complex military pay systems and regular updates to compensation rates and benefits, it is essential to rely on trusted sources like Military.com for accurate and up-to-date information. Make use of the resources available to you to stay informed and ensure you make the most of your military pay.

Basic Pay Rates for Commissioned Officers

The basic pay rates for commissioned officers in the military vary depending on their cumulative years of service and pay grade. These rates are outlined in the Department of Defense Financial Management Regulation (DoD FMR), Volume 7A, Chapter 1.

As officers progress through the ranks from O-1 to O-10, their pay increases with their years of service and rank. The pay rates for officers at pay grades O-7 to O-10 are limited by level II of the Executive Schedule. However, officers at pay grades O-6 and below have their pay rates limited to the rate of basic pay for Level V of the Executive Schedule.

It’s important to note that these rates are subject to change based on annual adjustments and other factors. To stay up-to-date with the latest pay rates for commissioned officers, you can refer to the DoD FMR or consult military resources such as Military.com.

Basic Allowance for Subsistence (BAS) and Clothing Monetary Allowances

In addition to basic pay, service members may be eligible for other allowances that contribute to their overall compensation and help cover necessary expenses. Two important allowances to consider are the Basic Allowance for Subsistence (BAS) and clothing monetary allowances.

Basic Allowance for Subsistence (BAS)

The Basic Allowance for Subsistence (BAS) is an allowance provided to offset the cost of a service member’s meals. It is designed to ensure that service members have access to adequate nutrition, even when meals are not provided by the military. The amount of BAS may vary based on a service member’s rank and dependency status.

Here is a breakdown of the current BAS rates for 2021:

Rank

Monthly BAS Rate

Enlisted

$386.50

Officer

$266.18

It’s important to note that BAS is not subject to federal income tax, making it a valuable addition to a service member’s overall compensation.

Clothing Monetary Allowances

Service members receive various clothing monetary allowances to ensure they have the appropriate attire for their military duties. These allowances cover the costs of initial clothing, replacements, civilian attire, and supplemental clothing for specific branches or occupational specialties.

Here are the different types of clothing monetary allowances:

Initial Clothing Allowances: This allowance provides funds to purchase essential initial clothing items when joining the military.

Cash Clothing Replacement Allowances: Service members receive cash allowances to replace worn-out or damaged clothing items.

Civilian Clothing Allowances: Some service members may be eligible for allowances to maintain a professional appearance when not in uniform.

Supplemental Clothing Allowances: Certain branches or occupational specialties have additional clothing allowances to cover specialized clothing requirements.

These clothing monetary allowances help service members meet the dress code and maintain professional standards while on duty and off duty.

Aviation Incentive Pays and Other Special Pay

The military recognizes the unique responsibilities and risks associated with certain military roles and offers various special pays to compensate these individuals. Aviation incentive pays and hazardous duty incentive pay are two examples of special pays available to officers and enlisted personnel.

Aviation incentive pays are provided to service members who perform flight duties. These pays are designed to attract and retain qualified aviation personnel and reflect the additional skills and training required for these roles. The exact amount of aviation incentive pays varies based on factors such as aviation length of service and aviation career incentive pay.

On the other hand, hazardous duty incentive pay is available to service members assigned to specific hazardous duty assignments. These assignments involve additional risks and challenges, and hazardous duty incentive pay is a way to recognize and compensate individuals for their service in these roles.

Understanding the specific details and rates for aviation incentive pays and hazardous duty incentive pay is essential to accurately assess their contribution to a service member’s overall compensation.

Aviation Incentive Pays

The following table provides an overview of aviation incentive pays available to officers and enlisted personnel who perform flight duties:

| Rank | Aviation Incentive Pay (Monthly) |

|—————-|———————————|

| Warrant Officer| $_________ |

| Enlisted | $_________ |

| Officer | $_________ |

Hazardous Duty Incentive Pay

The following table provides an overview of hazardous duty incentive pay rates for specific hazardous duty assignments:

| Hazardous Duty Assignment | Hazardous Duty Incentive Pay (Monthly) |

|——————————–|—————————————-|

| Assignment 1 | $_______________ |

| Assignment 2 | $_______________ |

| Assignment 3 | $_______________ |

These special pays, along with basic pay and other allowances, contribute to a service member’s overall compensation. It is important for service members to familiarize themselves with the details and eligibility requirements for these pays to fully understand their military compensation.

With the availability of aviation incentive pays and hazardous duty incentive pay, the military aims to attract and retain skilled individuals who serve in critical roles and face unique challenges. These special pays recognize the dedication and expertise required for flight duties and hazardous duty assignments, ensuring that service members are appropriately compensated for their vital contributions to the military.

Combat Zone Tax Exclusion and Other Pay-related Information

As a service member, understanding the various pay-related benefits and allowances is crucial for effectively managing your military compensation. In addition to the basic pay you receive, there are other pay-related aspects to be aware of, such as the Combat Zone Tax Exclusion (CZTE), hardship duty pay, and tax-exempt pay.

The Combat Zone Tax Exclusion (CZTE) is a valuable benefit for service members serving in designated combat zones. With the CZTE, you can exclude the pay you earn in these combat zones from taxable income. This exclusion can significantly reduce your overall tax burden and increase the amount of money you take home.

Hardship duty pay is another type of additional compensation that you may be eligible for. This pay is provided to service members serving in challenging and difficult locations. The amount of hardship duty pay varies depending on the level of hardship associated with the assignment. It serves as recognition for the sacrifices and challenges you may face while fulfilling your duties.

Additionally, there are various forms of tax-exempt pay available to service members. These types of pay are excluded from your taxable income, allowing you to keep more of your hard-earned money. It’s important to familiarize yourself with the specific tax-exempt pay options available to you and take advantage of these benefits.

Other Pay-related Information

In addition to the mentioned benefits, there are several other pay-related incentives and allowances that you should be aware of. These include:

Hazardous duty pay for non-flight-related duties

Foreign language proficiency bonus for service members with language skills

Health professions officers’ incentives and stipends for medical professionals in the military

Understanding these various pay-related benefits and allowances will empower you to make informed financial decisions and effectively manage your military compensation. It’s essential to stay up-to-date with the specific guidelines and requirements for each benefit to ensure that you can make the most of the opportunities available to you.

“Taking advantage of the Combat Zone Tax Exclusion and other pay-related benefits can have a significant impact on your overall financial well-being as a service member.”

– Military Financial Advisor

Pay-related Benefit

Description

Combat Zone Tax Exclusion (CZTE)

Excludes pay earned in designated combat zones from taxable income

Hardship Duty Pay

Additional compensation for service in challenging locations

Tax-Exempt Pay

Various forms of pay excluded from taxable income

Hazardous Duty Pay

Additional compensation for non-flight-related duties with increased risk

Foreign Language Proficiency Bonus

Extra pay for service members with language skills

Health Professions Officers’ Incentives and Stipends

Additional compensation for medical professionals

Understanding and utilizing these benefits will ensure that you receive the appropriate compensation and financial support for your service and dedication to our nation. Stay informed and take full advantage of the pay-related opportunities available to you as a valued member of the military.

Keep Up With Military Pay Updates

Military pay benefits are subject to constant changes and updates. To ensure that you stay informed and up-to-date with any changes to your military pay and benefits, it is advisable to subscribe to Military.com. By subscribing, you will receive regular updates on all military pay and benefits, delivered directly to your inbox. With the ever-changing nature of military compensation, it is essential to have access to the most current information to effectively manage your finances and understand your salary.

FAQ

What does the 2024 military pay chart show?

The 2024 military pay chart shows the salaries for active duty members of the Navy, Marine Corps, Army, Air Force, Coast Guard, and Space Force.

Will there be a pay raise in 2024?

Yes, there will be a 5.2% increase in military pay compared to 2023.

How is military pay determined?

Basic pay is determined by rank and years of service. Officers generally receive higher pay than enlisted service members, and the number of years served can impact pay.

What is the purpose of the Leave and Earning Statement (LES)?

The LES provides information about a service member’s entitlements, deductions, leave balance, and federal tax information.

What are tax-free allowances and special pay?

Tax-free allowances and special pay are additional forms of compensation that can contribute significantly to a service member’s paycheck. Examples include the Basic Allowance for Housing (BAH) and hazardous duty incentive pay.

Where can I find information about military pay changes?

You can find the latest news and updates on military pay, as well as access to pay charts and calculators, on the Military Pay section of Military.com.

How do basic pay rates vary for commissioned officers?

Basic pay rates for commissioned officers vary based on cumulative years of service and pay grade. The pay rates increase with years of service and rank.

What are the Basic Allowance for Subsistence (BAS) and clothing monetary allowances?

The BAS is an allowance provided to offset the cost of a service member’s meals. Clothing monetary allowances include various types of allowances to cover necessary clothing expenses.

What are aviation incentive pays and other special pay?

Aviation incentive pays are provided to officers and enlisted personnel who perform flight duties, while other special pays recognize unique responsibilities and risks associated with certain military roles.

What is the Combat Zone Tax Exclusion (CZTE) and other pay-related information?

The CZTE allows service members to exclude their pay earned in a designated combat zone from taxable income. Other pay-related information includes hardship duty pay, foreign language proficiency bonus, and health professions officers’ incentives and stipends.

How can I stay updated with military pay changes?

By subscribing to Military.com, you can receive regular updates on all military pay and benefits, delivered directly to your inbox.

The post 2024 Military Pay Chart – Understand Your Salary appeared first on Zac Johnson.